Insurance claims are where insurance promises are kept—or not. When health insurance operations experience a claim that's delayed, processed incorrectly, or challenged, it's not just a silo of inefficiency; it's an indicator of a brand that's fostering distrust amongst its customers and likely getting the attention of regulators. Unfortunately, for far too long, insurance companies have relied on manual (or semi-digital) efforts to manage claims, jeopardizing their customer- and cost-efficiency.

Now, claim automation in health insurance is an operational growth lever that few ever anticipated could change the game. Health insurance CEOs and key decision-makers are starting to realize that instead of viewing automation as a tool to cut costs and staff, it provides greater resilience, evolved risk avoidance, and better member experience in a digital-first health insurance arena.

From Transactional to Strategic: The Shift in Claims

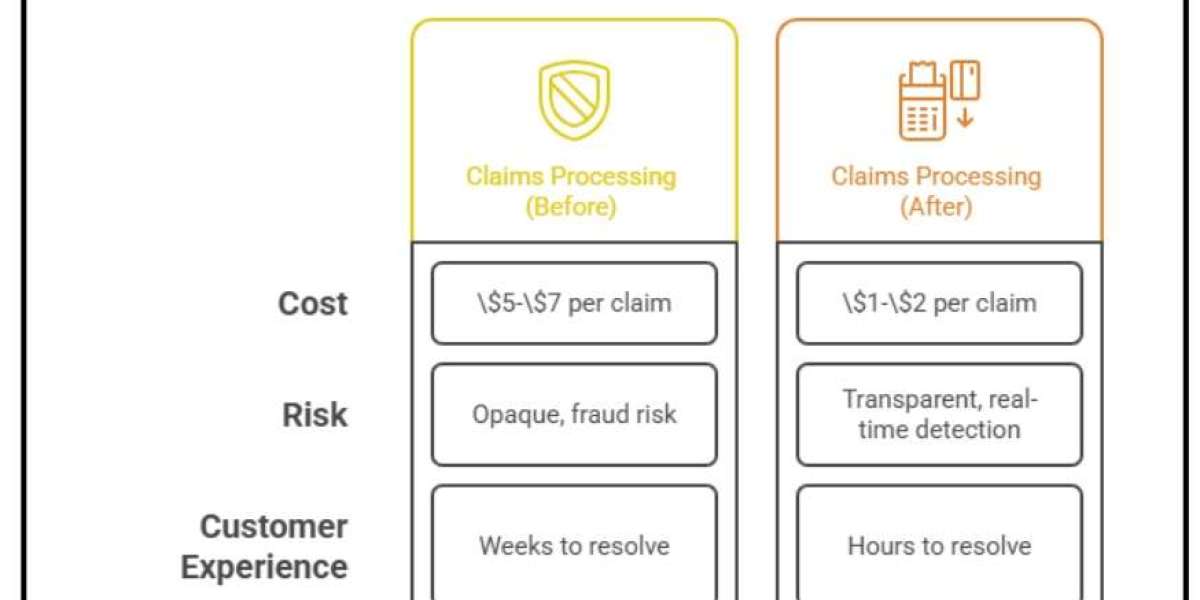

For years, claims processing was considered a transaction—submit the necessary documentation, review, authenticate and pay out—until automation makes it a strategic value-add with measurable ROI across various categories. The cost category supports how profitability increases; for example, where the average cost per claim to process is between $5–$7 per insurer, that drastically lowers to $1–$2 essentially per claim with more automation. In the risk category, transparency and real-time fraud detection thanks to AI purposefully attacks the $68 billion annual lost opportunity insurance fraud risk worldwide.

In addition, the customer experience category supports an automated approach to claims processing with the ability to resolve claims within hours rather than weeks, elevating customer satisfaction ratings and NPS scoring by as much as 20 to 30 points. Finally, beyond transaction/order fulfillment and customer-facing categories emerge around data as an asset—where claims data is merely a record it can subsequently become predictive analytics, which can drive innovation, pricing integrity and proactive loss avoidance. Therefore, claims processing and claims management are no longer a cost center but a value add to competitive advantage and growth opportunities.

What Automation Actually Delivers: Executive-Level Outcomes

Rather than focusing on process-level details, CEOs should evaluate outcomes.

Executive Priority | Impact with Claim Automation |

Cost Optimization | 30–60% reduction in processing costs |

Speed & Agility | Claims settled <24 hours for standard cases |

Fraud Prevention | 20–25% reduction in fraudulent payouts |

Compliance Assurance | Automated audit trails and rule-based validation |

Customer Retention | 2–3x higher renewal likelihood for satisfied claimants |

These are not “back-office wins”—they are strategic levers for profitability and market positioning.

The CEO Playbook for Claims Automation

Reframe Claims as a Customer Experience Function Claim is insurance's moment of truth. When automation can give the insurer low-risk claims paid out in almost real-time, the insurer essentially becomes a proactive customer-focused insurer rather than a stagnant payor. These perks impact retention and policyholder loyalty down the line, even on future policies with the same insurer.

Align Automation with Fraud & Risk Strategy Nothing creates distrust and destroys profitability like fraudulent claims. Therefore, connecting automated, AI discovered anomalies with a blockchain-created claim history not only minimizes fraud but also shows regulators and partners that the insurer has a risk awareness attitude. In turn, fraud prevention is part of the equation and keeps profit margins safe while saving brand identity.

Connect to Capital Planning\ Automation creates predictability just as much as it creates operational efficiencies. When claims are logged and processed in real-time, CFOs can apply predictive analytics to claims outflow to bolster reserves and better fund capital planning initiatives. Position financial stakeholders to rely upon enhanced decision-making during uncertain markets.

Champion Enterprise Confidence About Automation\ Enterprises rarely embrace automation. Choose to advocate for it as empowering staff—as letting people get away from dull verification processes and redeployed into other purpose-driven efforts like fraud prevention or customer-facing support opportunities. Collaborative communication fosters enterprise buy-in.

The Technology Layer: What Matters for CEOs

Yet where operational teams may identify these levers as enhancements, the perspective must shift for the CEO. The more they recognize automation as a technology lever, the more the claims arena can become a competitive advantage. For example, leverage Artificial Intelligence (AI) to adjudicate claims—if claims comply with the governed rules, automotive approval can take place by insurers, which can expedite response times and require less manual intervention. Use predictive analytics to project claims inflows and necessary reserves—not only does this help budgeting, but it is also useful for liquidity, providing the ability to better understand unexpected inflows.

From a compliance perspective, leverage integration with blockchain—as a positive, insurers can leverage improved compliance as immutable records—records that can never be changed once documented—which project transparency and trust within the organization and with regulators. Use Natural Language Processing (NLP)—to change consumer experience—the policyholder doesn't have to call the insurer to find out the status of a claim; they can say or type their question, which reduces friction and improves satisfaction. Finally, leverage hyperautomation—the orchestration of RPA, AI and process mining—to ensure true, end-to-end integration; this drives integration at the workflow level while creating a seamless, responsive system that adapts to business needs over time.

Barriers to Adoption—and How Leaders Can Navigate Them

Perhaps the biggest obstacle to automation is legacy infrastructure—which is why purchasing solutions with best in class APIs and out-of-the-box connectors is critical. This encourages new systems to easily connect and become part of existing ones without interference, driving time-to-value. Similarly, cultural resistance is critical to overcome. Employees may see opportunities for automation as threats to their jobs; change management strategies can position it instead as a career opportunity—focusing on strategic work in more valuable areas instead of being mired in repetitive tasks.

Ongoing concern must also be awareness surrounding data security. Vendors should be researched and vetted for HIPAA, GDPR, SOC 2, ISO 27001 and other safeguards of sensitive data that ensure peace of mind for regulators and clients, increasing loyalty and trust for all. Finally, an ROI measurement methodology should be non-negotiable. Sophisticated CEO-level KPIs—cost per claim, fraud savings, improvement in Net Promoter Score (NPS), reserve optimization—will pervade from automation programs to ensure the transformations have everything to do with financial and strategic concerns. This level of scrutiny transforms automation from a technological endeavor to one that takes place in the boardroom for profit and sustainability.

Final Word for CEOs

The success of health insurance's future will rely on how companies manage their moments of truth—claims. Manual operations have no place—they are too costly, too inefficient and overly risky.

CEOs of health insurance companies who champion claims automation will reduce costs while increasing brand reputation, regulatory compliance and competitive differentiation. Those who fail to act will fall behind as nimble insurers make claims automation their DNA for success.

In an increasingly digitized world, automation is no longer a mere operational activity. It's a cornerstone of competitive advantage.