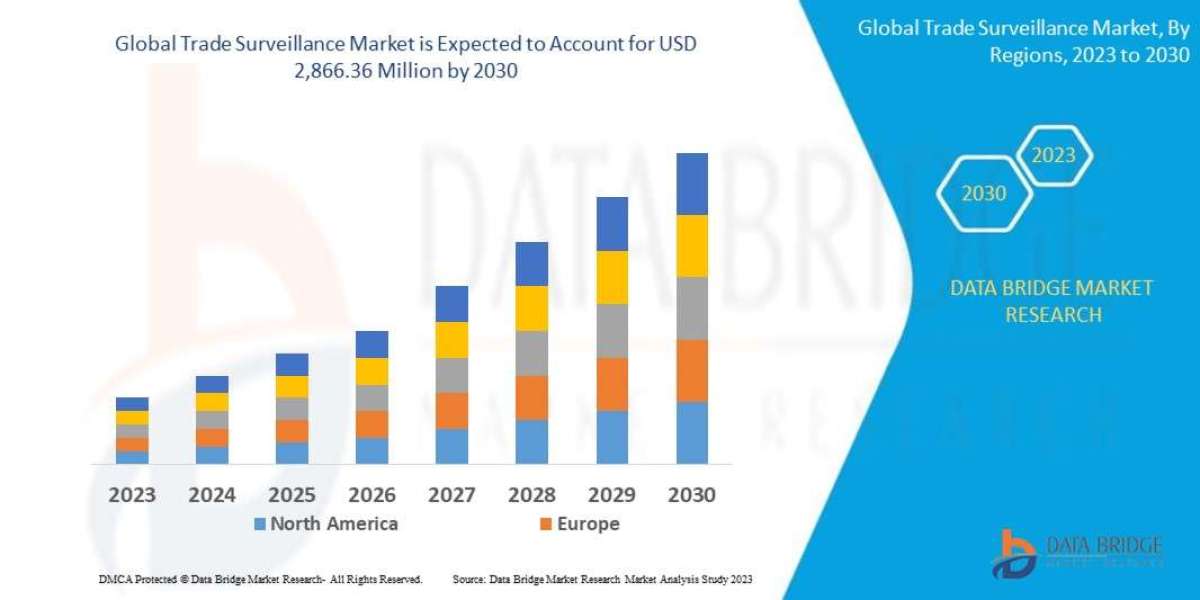

Theglobal trade surveillance marketis experiencing significant growth and is expected to continue on a positive trajectory up to 2030. With the market value projected to increase from902.21 USD million in 2022 to 2866.36 USD million in 2030, it is evident that there is a strong demand for trade surveillance solutions worldwide. This growth can be attributed to several key factors, including increasing regulatory scrutiny, the rise of complex trading instruments, the need to prevent market abuse and insider trading, and the expanding adoption of advanced technologies such as artificial intelligence and machine learning in surveillance systems.

Despite the challenges posed by the Covid-19 pandemic, the trade surveillance market has shown resilience and adaptability in the face of unprecedented disruptions. The pandemic highlighted the importance of robust surveillance systems in maintaining market integrity and safeguarding against financial crimes in a remote working environment. As economies recover post-Covid, organizations are expected to invest more in enhancing their surveillance capabilities to mitigate risks and ensure compliance with evolving regulations.

Looking ahead to the forecast period up to 2030, theglobal trade surveillance marketis poised for substantial growth driven by the increasing volume of trade transactions, regulatory requirements, and the growing complexities of financial markets. Market sentiments are optimistic as businesses prioritize investment in sophisticated surveillance tools to effectively monitor activities across multiple asset classes and geographies. Furthermore, the integration of automation and analytics in surveillance platforms will enable organizations to proactively identify and address potential misconduct, thereby strengthening market transparency and investor confidence.

For more detailed insights, refer to:https://www.databridgemarketresearch.com/reports/global-trade-surveillance-market

Global Trade Surveillance Market*

Components:

- Solutions: Trade surveillance software, communication monitoring tools, trade reconstruction solutions.

- Services: Consulting services, managed services, training and support.*

Deployment Model:

- Cloud: Increasing adoption due to scalability, flexibility, and cost-effectiveness.

- On-Premises: Preferred by organizations with strict data security and compliance requirements.

- Hybrid: Combination of cloud and on-premises for customized solutions.

Organization Size:

- Large Enterprises: Investing in comprehensive surveillance solutions to manage complex trading activities.

- Small and Medium-Sized Enterprises (SMEs): Adopting cost-effective surveillance tools to meet regulatory demands.*

Vertical:

- Capital Markets: High need for real-time monitoring of trading activities to detect anomalies and market abuse.

- Banking Financial Services and Insurance (BFSI): Stringent regulations driving the adoption of advanced surveillance technologies.

The global trade surveillance market is witnessing significant growth due to the convergence of various factors, including regulatory scrutiny, the proliferation of complex trading instruments, and the adoption of advanced technologies. The demand for trade surveillance solutions is fueled by the need to combat market abuse, insider trading, and other financial crimes in an increasingly digitized and interconnected trading landscape.

The Covid-19 pandemic acted as a catalyst for the adoption of robust surveillance systems, emphasizing the importance of maintaining market integrity amidst disruptions. As economies recover, organizations are expected to prioritize investments in enhancing surveillance capabilities to ensure compliance with evolving regulations and mitigate risks associated with remote working environments.

Looking ahead, the market is poised for substantial growth driven by the rising volume of trade transactions, regulatory requirements, and the complexities of global financial markets. Businesses are increasingly investing in sophisticated surveillance tools to monitor activities across asset classes and geographies effectively. Automation and analytics integration in surveillance platforms will enable proactive identification and mitigation of potential misconduct, thereby enhancing market transparency and investor confidence.

Overall, the global trade surveillance market is set to experience continued expansion as organizations across industries recognize the critical role of surveillance in maintaining market integrity, regulatory compliance, and safeguarding against financial crimes. Continuous innovation, technological advancements, and strategic investments will be key drivers shaping the future landscape of trade surveillance solutions.

Market Players:

- NICE Actimize (U.S.)

- Nasdaq, Inc. (U.S.)

- FIS (U.S.)

- FISERV (U.S.)

- Software AG (Germany)

- IPC Systems, Inc. (U.S.)

- Scila AB (Sweden)

- Ancoa Software Ltd. (U.K.)

- B-Next (Italy)

- Cinnober Financial Technology (Sweden)

- OneMarketData, LLC (U.S.)

- Thomson Reuters (Canada)

- Smarsh (U.S.)

- Aquis Technologies (U.K.)

- Eventus Systems, Inc. (U.S.)

Browse More reports

Global Sports Analytics Market -https://www.databridgemarketresearch.com/reports/global-sports-analytics-market

Global CAR-T Cell Therapy treatment Market -https://www.databridgemarketresearch.com/reports/global-car-t-cell-therapy-treatment-market

Global Drug Safety Solutions and Pharmacovigilance Market -https://www.databridgemarketresearch.com/reports/global-drug-safety-solutions-and-pharmacovigilance-market

Global Embedded Systems Market -https://www.databridgemarketresearch.com/reports/global-embedded-systems-market

Global Digital Insurance Platform Market -https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market

The global trade surveillance market is evolving rapidly, driven by increasing regulatory scrutiny, the complexity of modern trading instruments, and the adoption of advanced technologies. Market players such as NICE Actimize, Nasdaq, Inc., and FISERV are at the forefront of providing innovative solutions to meet the growing demand for trade surveillance capabilities globally.

These market players offer a range of trade surveillance software, communication monitoring tools, and trade reconstruction solutions to help organizations effectively monitor and analyze trading activities. With a focus on providing comprehensive surveillance services, including consulting, managed services, and training, these companies play a crucial role in assisting businesses in enhancing their surveillance capabilities and staying compliant with regulatory requirements.

The deployment models offered by market players cater to diverse organizational needs, whether it is cloud-based solutions for scalability and flexibility, on-premises options for data security, or hybrid models for customized surveillance setups. This flexibility allows organizations of all sizes, from large enterprises to small and medium-sized businesses, to access surveillance tools tailored to their specific requirements.

In verticals like capital markets and BFSI, where real-time monitoring and detection of anomalies are critical, market players are leveraging advanced technologies like artificial intelligence and machine learning to provide cutting-edge surveillance solutions. These technologies enable proactive identification of market abuse, insider trading, and other financial crimes, thereby enhancing market transparency and investor confidence.

As businesses continue to navigate the complexities of global financial markets and evolving regulatory landscapes, market players are expected to play a crucial role in driving innovation and shaping the future of trade surveillance solutions. With a focus on automation, analytics, and integration, these companies are well-positioned to help organizations proactively address potential misconduct, mitigate risks, and ensure market integrity in the years to come.